Showing posts with label Energy and Capital. Show all posts

Showing posts with label Energy and Capital. Show all posts

Thursday, February 21, 2013

First Solar Power Cells Cheaper than Coal Power

Ateneo Innovation and Entrepreneurship

"New ideas create more and better new products and services; create more wealth."

From Energy and Capital by Shwagato Chakravorty February 4, 2013

First Solar Macho Spring Project in New Mexico can supply electricity at 5.79 cents/kwh (PHP 2.40) which is much lower than coal power estimated to be 12.8 cents/kwh for coal power. This is very significant because this the very first time that solar is cheaper than conventional.

The Macho Spring Project has 50 MW capacity.

From Energy and Capital by Shwagato Chakravorty February 4, 2013

First Solar Macho Spring Project in New Mexico can supply electricity at 5.79 cents/kwh (PHP 2.40) which is much lower than coal power estimated to be 12.8 cents/kwh for coal power. This is very significant because this the very first time that solar is cheaper than conventional.

The Macho Spring Project has 50 MW capacity.

Friday, January 4, 2013

Bullish On Oil

---------- Forwarded message ----------

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Thu, Jan 3, 2013 at 1:14 AM

Subject: Bullish On Oil

![]()

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Thu, Jan 3, 2013 at 1:14 AM

Subject: Bullish On Oil

Bullish On Oil

By Nick Hodge | Wednesday, January 2nd, 2013

I have a secret.

Amid all the talk of an "oil boom," the world still consumes more oil than it produces.

It's an open secret. The EIA publishes the data right on its website.

Here's an unadulterated image of it:

There it is, plain as day.

In the most recent year for which there's data, the world consumed 87.421 million barrels of oil per day.

It produced 87.085 million.

Boy and girls, what happens when demand is greater than supply?

That's right! Prices go up.

They started 2011 at $91.58 and finished at $99.73.

And have a look at the broader five-year trend:

When the global economy isn't experiencing economic death throes, the market knows oil should head higher.

And that's what it's done since 2009, when Texas crude bottomed out at $37.00.

Advertisement

3 Fracking Superstars

There are a few truths to the fracking superboom going on in the United States:

Get all the details here — before it's too late.

We live on the cusp, not realizing how close we are each day to not having enough. But the just-in-time method has weak links, doesn't it?

New York and New Jersey rationed gas by license plate number just two months ago.

What Happens When...

Six of the top ten oil-producing countries are now also on the list of top oil-consuming countries?

But here's the thing: Their rate of consumption is growing much faster than production growth, especially in Saudi Arabia and Brazil. I wouldn't be surprised if Mexico made the top consumers list some year soon as well.

When these countries had smaller populations and economies, they didn't need as much oil. Now that they're growing, they need more of their oil for themselves. And that means less oil available for the global market — and for importers like the U.S. and China.

Prices have to rise.

I've said it before and I'll say it again: I go long oil when it's below $85.

I trade it with the ProShares Ultra Crude Oil ETF (NYSE: UCO). I've had Early Advantage readers do it ten times now. And we've never lost on it.

Advertisement

"There's enough oil below American soil to put OPEC out of business for good!"

They said it couldn't happen...

One day, the U.S. would produce enough oil to kick OPEC to the curb.

That day is here — and these 3 companies are making it happen.

The global oil market is so tight that one positive economic announcement or one supply disruption sends prices soaring.

And even with the shale revolution we — and now everyone else — have been telling you about, the United States still consumes 18.9 million barrels per day while producing 10.13 million barrels. So much for oil independence.

However, higher prices do make shale drillers more profitable.

That's why energy investors love high oil prices. It makes profiting so much easier.

So in addition to playing the price as I just described above, make sure you check out the latest ways to profit from domestic producers as prices head higher.

Oil's gone from $88.00 to $93.00 over the past few days...

It's left my portfolio a bit higher — and me scratching my head at respected analysts who were calling for $40 oil within 12 months this past spring.

Some people will never get it.

Call it like you see it,

Nick is an editor of Energy & Capital and the Investment Director of the thousands-strong stock advisory, Early Advantage. Co-author of the best-selling book Investing in Renewable Energy: Making Money on Green Chip Stocks, his insights have been shared on news programs and in magazines and newspapers around the world. For more on Nick, take a look at his editor's page.

The Bottom Line

Related Articles

2013 Oil Price Forecast2013 Natural Gas Forecast 2013 Offshore Outlook Obama Has Big Plans for Nuclear Energy in 2013

Recently...

11 Countries Will Go Basel...Before Captain Drake, There Was Grok the Caveman Preparing to Invest in 2013 Buy Now! Energy and Capital's Weekend Edition | |

This email was sent to jorgeus.george@gmail.com . You can manage your subscription and get our privacy policy here.

Energy and Capital, Copyright © 2013, Angel Publishing LLC, 1012 Morton St, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

Wednesday, December 26, 2012

The Most Popular Letter of the Year

---------- Forwarded message ----------

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Wed, Dec 26, 2012 at 1:08 AM

Subject: The Most Popular Letter of the Year

![]()

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Wed, Dec 26, 2012 at 1:08 AM

Subject: The Most Popular Letter of the Year

The Most Popular Letter of the Year

By Nick Hodge | Tuesday, December 25th, 2012

Dear Reader,

Our idea for today was to send you the most popular article of the year.

Unfortunately, in the times we live in, your favorite articles don't do much for spreading holiday cheer... We don't wear rose-colored glasses around here. We like to think that's why you read us.

So, at the risk of being labeled a Scrooge, here's a reprinting of the article Energy and Capital readers chose as the most-liked of the year.

Enjoy...

Nick

America sucks.

It hasn't always. But it does right now. And it doesn't have to stay that way. You can change it...

Of course, some people won't agree with me. They'll say it's the greatest nation on earth. The freest. Home of the brave.

To them I ask: Would the freest nation on earth publicly execute a wheelchair-bound double amputee at a home for the mentally ill?

It happened recently in Houston. The courageous men in blue there opened fire on the man who was wielding a pen after he demanded a cigarette and a soda.

This guy had one arm and one leg and was mentally ill. Houston cops shot him in the head.

How brave they were. How free we are.

Advertisement

Al Gore Dumps Green Energy!

According to the Washington Post, Al Gore made $100 million from investing in government-backed "green" energy firms...

Now he can't get out of them fast enough!

And it's no wonder, as dozens of these epic failures continue to drop like flies after gorging themselves on $90 billion of your money.

Get all the scandalous details right here.

Six Michigan police fired 46 bullets at a mentally ill homeless man in July.

Michigan's finest, well-trained, and noble officers hit the man 11 times — with fewer than 25% of their shots.

Two of those fine Michigan men have been reprimanded; one has been demoted. Their names were not released.

These are the kind of militarized morons policing our country. Protecting us no more, their job is to instill fear and keep the populace at bay.

But that's how it is, isn't it? A veil of secrecy has been erected between the government (and its enforcers) and the people.

You vote for a candidate who pledges to do X or to repeal Y, and what do you get? Nothing. Their agenda is their own, formulated at the request of the highest bidder, meant only to further entrench their power and line their pockets...

Big Pharma. Big Retail. Big Tobacco. Big Health Care. Big Oil. Big Agriculture. Big Banks. Big Government.

Take Two Every 8 Hours, Stay Off Drugs

Prescription pills kill 140,000 people every year in the United States, severely injure one million, and send two million to the hospital.

Side effects include brain damage, stroke, pulmonary disease, cardiac arrest, perforated ulcers, cancer, liver failure, and addiction.

Those are legal drugs.

Illegal drugs kill about 5,000 Americans per year, mostly from cocaine and heroine.

Tell me, on which drugs should we wage a war?

The facts are clear. But Big Government and Big Pharma — which spends $100 million per year lobbying (bribing) politicians — can't get a cut from the "bad" drugs.

So 1.5 million Americans are locked up each year for illegal drug-related crimes, while Big Pharma drug reps make great livings taking doctors out for expensive lunches every day so they push their pills.

And 80% of those 1.5 million arrests are for possession, so those fine cops mentioned earlier aren't even getting the distributors.

What's more, 44% of possession arrests are for marijuana — which kills no one — rather than for the harder stuff that does.

Yet since the 1980s over a quarter-trillion of your tax dollars have gone to fight a war on drugs that kills millions fewer people than the legal ones executives and congressmen are profiting from.

Drug dealing isn't drug dealing when it's state sanctioned.

Advertisement

On January 1, 2013: Gold = Money

Massive Revalue: Gold as a Tier 1 Asset

The biggest upside catalyst for gold is a massive reevaluation by the Basel Committee of Bank Supervision.

BCBS sets the international rules for banks. Currently gold is rated as a Tier 3 asset. This means banks can only carry 50% of its market value as capital.

This will change in a few short months...

The Basel Committee is planning on turning gold into a Tier 1 asset so that it can be carried at 100% of its value. The more Tier 1 assets a bank has, the more money it can lend.

This will double the price of gold almost overnight. You must act now!

To quote Gerald Celente, whose book What Zizi Gave Honeyboy inspired this essay: "It actually all makes perfect sense in a system in which justice is measured by the size of political campaign contributions."

And it's not only pharmaceutical drugs; the hypocrisy is multiplied when you inspect alcohol and tobacco, which do tens of billions each year in sales and spend hundreds of millions bribing so-called 'lawmakers.'

Smoking kills about 450,000 Americans each year. Alcohol kills another 150,000.

But remember, kids, Altria (Philip Morris), Anheuser-Busch, and Pfizer bribe the government. They have sales goals to meet. Pot growers don't.

Shit: It's What's for Dinner

Lamar Carter is a cattle farmer. He feeds his cows shit.

He's cited in a U.S. News & World report as buying 745 tons of chicken scat and stacking it 12 feet high on his farm. After it sits for seven to 10 days, it's mixed with a small amount of soy bran... and fed to his hundreds of cows.

He's quoted as saying: "My cows are fat as butterballs. If I didn't have chicken litter, I'd have to sell half my herd. Other feed's too expensive."

You may have also heard the recent story going around about another cattle farmer feeding candy to his cows.

And I shouldn't have to recount the squalid conditions your beef and chicken inhabit while alive, injected with hormones and antibiotics (half of the antibiotics made in the U.S. are for animals), starved, and then force-fed to

I won't even tell you where millions of euthanized dogs and cats end up.

Is it any surprise 80 million Americans contract a foodborne illness annually (over a quarter of the population), 9,000 of them meeting their maker because of it?

Have you noticed there were no warnings for eating undercooked meat or eggs 20 years ago?

But like drugs, where does the regulator's hammer come down?

Surely not on the Hormels, Cargills, Tysons, and Perdues who are so profit-hungry they feed the animals you eat feces... but on the small mom-and-pop farmers trying to make it on their own selling all-natural beef, chicken, and vegetables.

In many states, it's illegal to sell raw milk. In others, small farms have been raided at gunpoint. (By whom? By those lovely militarized police we talked about earlier.)

Guess which operations have enough to bribe the lawmakers you elected?

And then those politicians have the gumption to decry the loss of small businesses during their election campaigns when it's them putting them out of business.

Advertisement

Have You Heard About This Government-Aided Profit Program?

I recently learned of an ex-fireman who's been using an underground profit secret to magnify his wealth many times over.

It has nothing to do with stocks... options... bonds... or anything else you've likely come across.

Instead, it's a unique way to make money using a government-aided program that's been in place since 2010.

Click here for the full details on this program — and how you could start multiplying your cash.

America!

I could go on and on about the current injustices plaguing the American system. (And I will next week... and the one after that.)

Like how your Nobel Peace Prize-winning president increased troop levels in Afghanistan, a so-called "troop surge," who are now coming home and "leaving behind an uncertain landscape of rising violence and political instability that threatens to undo considerable gains in security," as the NYT reported last week.

Last year was the deadliest year for American troops in Afghanistan since the war began. This year could rival it.

Soldier suicides are at an all-time high, and are beginning to outpace deaths on the battlefield. That's some kinda peace.

There was once a time when leaders like Washington and Eisenhower actually led wars. And they knew the desperation it caused — and that it should be used only as a last result.

Now we carry on wars for years, the suffering felt only by the lower classes, while draft-dodgers, community organizers, and Mormon teachers decry its necessity having never witnessed first-hand its atrocities. If they want a war so bad, I say give them a rucksack and rifle and send them out there.

Try to guess how much money Lockheed and Raytheon and Northrup Grumman spend taking your elected officials out to dinner. (It was up 11.5% in the first quarter this year to just under $16 million.)

Or how about the constant flow of banking scams at the highest level, only to never see any major prosecutions or law changes...

You might understand why if you knew the banks and their political action committees (bribe squads) spent nearly $20 million on political candidates — Democrat and Republican — in 2010.

Banks like JPMorgan, Citigroup, and Bank of America have spent $16 million since 2011 trying to get people elected who make or bend laws in their favor. Congressmen, on average, get $20,000 per year from the banks. Senators get about $30,000, but it was up near $100,000 leading up to the implosion of our economy.

No wonder they continue to bill this as "the greatest nation on earth"...

They're making money hand over fist while everyone else struggles.

What I don't understand is why the majority continue to buy into it.

It was Hitler who said if you repeat the same lie often enough, people will eventually believe it.

So How Great Is It?

It's great enough that Americans now work 160 more hours per year than they did 20 years ago.

And for what?

How's your purchasing power? Your home value? Your savings account?

It's no wonder a majority of people think the country is suffering from a moral breakdown.

To quote from Celente's book:

If the "American way" was working so well, why was "stress" cited as the primary cause for the 25% increase in sick days? Why do stress-related problems account for 60% to 90% of doctors' visits in the United States?

If "life has gotten better," why are 5% of our children being fed Ritalin to calm them down, and why are we gulping down more than a million dollars' worth of Prozac a day to keep steady?

I think it's because they're chasing a dream they know they can't attain — or worse, no longer even exists.

Advertisement

The Wal-Mart "Triple Dividend" Secret

Wal-Mart currently pays a 2.6% dividend. Not bad for one of the most stable companies in the entire world...

But there's an easy way you can stick with Wal-Mart — and triple that dividend payment.

Almost one-third of Americans say they've been on the verge of a nervous breakdown.

For years now there's been a growing sense of something being truly wrong with our country. The Occupy Movement has been the most vocal about it, but they aren't fully representing the problem.

Bankers, for all their faults, are only leveraging the system they live in; the Supreme Court, after all, has affirmed that companies are people, and can donate limitlessly and anonymously to political campaigns.

We've allowed our country to reach a point where we've sold our happiness and sense of community to the highest bidder, and only those at the top of industry and top of government get true profit.

A family of four could once live well on one salary. Now two aren't enough to scrape by.

As Celente concludes in the chapter entitled, "Make money your God and it will plague you like the devil":

If the facts show — and the people say — they're unhappy and morally starved, and large numbers are on the verge of cracking up, is the "American way" delivering on its promise?

When the media and politicians talk about other nations that don't have the financial and material riches of the United States, they tell us the people in those countries are "living in poverty," but as any seasoned world traveler will tell you, "poverty" is a relative term. It can be argued that while people living in poor nations lack our material comforts, many of them possess the wealth of community and the family prosperity that has dissipated in America and among her people.

A close friend of mine, a mid-level derivatives manager at Citi, recently quit his job to move to South America. An accountant here in my office headed to Melbourne,

Departing isn't the only option, though it is increasingly appealing. I'm going to stick it out here for a while, perhaps on a remote farm, if I can swing it...

Of course, no matter where you choose to live, acquiring and growing capital always makes it easier.

I'll continue to try to help you do that every week — while also wading through the events and policies of a stranger and stranger world.

Call it like you see it,

Nick is an editor of Energy & Capital and the Investment Director of the thousands-strong stock advisory, Early Advantage. Co-author of the best-selling book Investing in Renewable Energy: Making Money on Green Chip Stocks, his insights have been shared on news programs and in magazines and newspapers around the world. For more on Nick, take a look at his editor's page.

The Bottom Line

| |

This email was sent to jorgeus.george@gmail.com . You can manage your subscription and get our privacy policy here.

Energy and Capital, Copyright © 2012, Angel Publishing LLC, 1012 Morton St, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

--

Jorgeus George

Friday, December 21, 2012

Energy and Capital - this is crazy!

---------- Forwarded message ----------

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Thu, Dec 20, 2012 at 7:06 PM

Subject: Re: this is crazy!

![]()

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Thu, Dec 20, 2012 at 7:06 PM

Subject: Re: this is crazy!

Re: this is crazy!

By Nick Hodge | Thursday, December 20th, 2012

It's only been circulating for a short time, but it already has everyone in the energy industry talking.

Why?

Well, it contains the full details on a development in the energy sector that could change our lives — and investments — forever...

And possibly ruin them if you don't know what you're doing.

It's a very serious, potentially life-changing situation. I suggest you check out the full details here.

Call it like you see it,

Nick Hodge

Managing Editor, Energy and Capital Energy and Capital, Copyright © 2012, Angel Publishing LLC, 1012 Morton Street, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law. Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. |

Monday, October 22, 2012

Metals recovery from mining ores using bacteria

Ateneo Innovation and Entrepreneurship

"New ideas create more and better new products and services; create more wealth."

From energy and capital

One of the biggest problems of mining company is how to make mining operations efficient; ie recover most of the metals and without toxicity and harmful effect on the environment. Recovery from mining ores uses toxic chemicals like cyanide and harms the water supply and water and marine life.

Enters nature hardworking miners - bacteria.

I hope PHILEX in the PHL knows about this technology

But not so with Talavivaara Mining in Europe. In just 27 months 78% of the metals were recovered.

Know more about the bacteria miners at Talvivaara mining

The rare and precious metals that are found in this mines include: copper, chromium, vanadium, zinc, molybdenum (useful in nuclear reactors), uranium, lithium (major component of electronic equipment batteries, and vanadium. Investment in this company is good investment. Could be a six bagger.

From energy and capital

One of the biggest problems of mining company is how to make mining operations efficient; ie recover most of the metals and without toxicity and harmful effect on the environment. Recovery from mining ores uses toxic chemicals like cyanide and harms the water supply and water and marine life.

Enters nature hardworking miners - bacteria.

I hope PHILEX in the PHL knows about this technology

But not so with Talavivaara Mining in Europe. In just 27 months 78% of the metals were recovered.

Know more about the bacteria miners at Talvivaara mining

The rare and precious metals that are found in this mines include: copper, chromium, vanadium, zinc, molybdenum (useful in nuclear reactors), uranium, lithium (major component of electronic equipment batteries, and vanadium. Investment in this company is good investment. Could be a six bagger.

Sunday, September 16, 2012

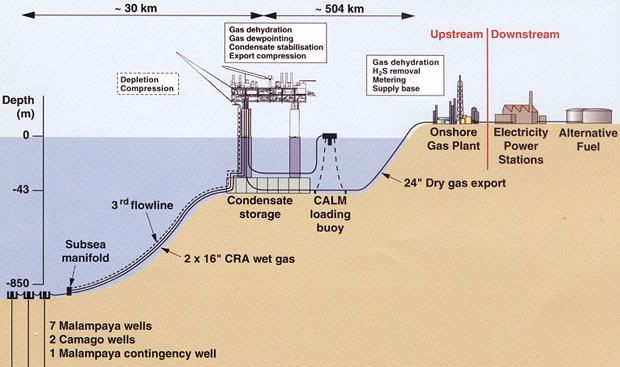

US Energy has shifted to natural gas

Ateneo Innovation and Entrepreneurship

From energy and capital

Is it natural gas, renewables, or solar energy that is the new opportunity for north America.

It is going to be natural gas. As of 2012, the building of powerplants is toward natural gas (Is natural gas renewable?) 80% of the those powerplants are geared towards combined/natural gas.

In 2011, the highest production of natural gas was in Haynesville.

In 2012, it is Marcellus formation producing 7.4 Billion cubic feet of NG in a day. Because of this record production though, prices dropped from a high of nearly $14.00/ cubic feet to less than $3.00. China is investing in these NG companies to feed its hungry demand for energy

Natural gas stocks

"New ideas create more and better new products and services; create more wealth."

From energy and capital

Is it natural gas, renewables, or solar energy that is the new opportunity for north America.

It is going to be natural gas. As of 2012, the building of powerplants is toward natural gas (Is natural gas renewable?) 80% of the those powerplants are geared towards combined/natural gas.

In 2011, the highest production of natural gas was in Haynesville.

In 2012, it is Marcellus formation producing 7.4 Billion cubic feet of NG in a day. Because of this record production though, prices dropped from a high of nearly $14.00/ cubic feet to less than $3.00. China is investing in these NG companies to feed its hungry demand for energy

Natural gas stocks

"New ideas create more and better new products and services; create more wealth."

Sunday, August 26, 2012

Global opportunities for Nuclear Power

From Energy and Capital Jeff Siegel

The plan for nuclear power plants in US, including the renewal of licenses are being delayed. The issue is political. The trade deficit for oil imports amount to $l0 billion a month. This dirty money was even funding Bin Laden anti US activities. Jeff Siegel proposes to stop this foolishness by going nuclear.

OECD countries like South Korea, Japan (despite the tsunami and Fukushima meltdown) China, India, and Russia are planning for nuclear power plants. Their project alone could account for 44 per cent growth in the nuclear power energy growth for the next 20 years.

This will fuel demand for more uranium. A safer uranium fuel (enriched with molybdenum oxide) will deliver more energy and make nuclear waste safer to handle

Ateneo Innovation and Entrepreneurship "New ideas create more and better new products and services; create more wealth."

The plan for nuclear power plants in US, including the renewal of licenses are being delayed. The issue is political. The trade deficit for oil imports amount to $l0 billion a month. This dirty money was even funding Bin Laden anti US activities. Jeff Siegel proposes to stop this foolishness by going nuclear.

OECD countries like South Korea, Japan (despite the tsunami and Fukushima meltdown) China, India, and Russia are planning for nuclear power plants. Their project alone could account for 44 per cent growth in the nuclear power energy growth for the next 20 years.

This will fuel demand for more uranium. A safer uranium fuel (enriched with molybdenum oxide) will deliver more energy and make nuclear waste safer to handle

Ateneo Innovation and Entrepreneurship "New ideas create more and better new products and services; create more wealth."

Rare earth metals and new method of metals recovery

Ateneo Innovation and Entrepreneurship

Nick Hodges of Energy and capital wrote about new method of metals recovery. Talvivaara Mining has such a unique process:

l. Ore is mined and stacked in a heap pad;

2. Bacteria is sprinkled onto the ore; water makes the bacteria seep into the ore, fans feed more of the bacteria into the ore.

3. Bacteria eats into the ore; and releases chemicals that eat into the ore;

4. Metals are recovered, and the solutions coming from the process are sent back to the ore heap.

With a little help from nature.

Investing into this kind of mining means access to precious metals and rare earth. For example, electric cars, the wave of the future would require plenty of battery power, coming from lithium, a rare earth element, (REE)

"New ideas create more and better new products and services; create more wealth."

Nick Hodges of Energy and capital wrote about new method of metals recovery. Talvivaara Mining has such a unique process:

l. Ore is mined and stacked in a heap pad;

2. Bacteria is sprinkled onto the ore; water makes the bacteria seep into the ore, fans feed more of the bacteria into the ore.

3. Bacteria eats into the ore; and releases chemicals that eat into the ore;

4. Metals are recovered, and the solutions coming from the process are sent back to the ore heap.

With a little help from nature.

Investing into this kind of mining means access to precious metals and rare earth. For example, electric cars, the wave of the future would require plenty of battery power, coming from lithium, a rare earth element, (REE)

"New ideas create more and better new products and services; create more wealth."

Tuesday, August 21, 2012

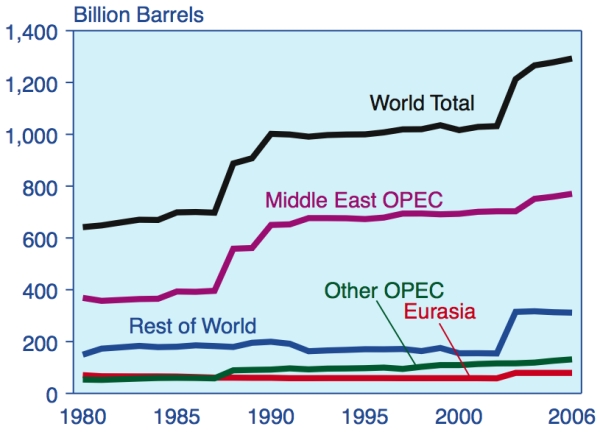

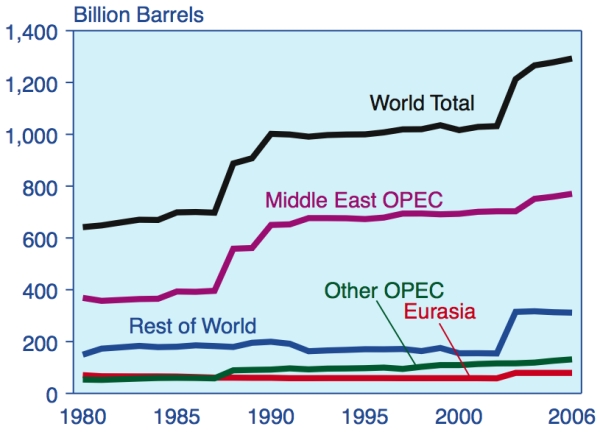

Let us end OPEC might.

Live Curious

For a long long time, the Western and the rest of the world have been screwed by OPEC - lowering oil production quotas and raising prices. Many common men have been led to believe that oil prices are manipulated by oil refineries and retailers. They do not know that the cause of the increase are the Arab nations. (and South American oil cartels.)

Jeff Siegel suggests that by raising local production, using fuel efficient cars or hybrid, these countries can yield less clout. The idea of using the wealth gained from your purchase of their products to hurt the customer is unacceptable.

OPEC must be finished.

Flat history, not much production/exploration

Ateneo Innovation and Entrepreneurship "New ideas create more and better new products and services; create more wealth."

-------------------------------------------------------------------------------------------------------------------

For a long long time, the Western and the rest of the world have been screwed by OPEC - lowering oil production quotas and raising prices. Many common men have been led to believe that oil prices are manipulated by oil refineries and retailers. They do not know that the cause of the increase are the Arab nations. (and South American oil cartels.)

Jeff Siegel suggests that by raising local production, using fuel efficient cars or hybrid, these countries can yield less clout. The idea of using the wealth gained from your purchase of their products to hurt the customer is unacceptable.

OPEC must be finished.

Flat history, not much production/exploration

Ateneo Innovation and Entrepreneurship "New ideas create more and better new products and services; create more wealth."

-------------------------------------------------------------------------------------------------------------------

OTHER NEW IDEAS ARTICLES

Wednesday, August 1, 2012

What is China doing with oil supplies in America and Asia

Bakken, North Dakota Oil fields

China is investing billions for its strategic oil supplies. It just not trust that OPEC and Russia will keep the oil steady and firm.

It is thus on an investing spree for the shale gas in North America and elsewhere in the world.

Why is it keen on Spratly? It has proven oil reserves that is bigger than Kuwait and many Filipinos know this. The Chinese exploration co. knows this...

Spratly sits on rich oil reserves: 3.4 trillion cubic feet of natural gas and 440m million barrels of oil.

Now you know....Spratly's remain an issue because of rich oil reserves

---------- Forwarded message ----------

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Tue, Jul 31, 2012 at 10:47 PM

Subject: China is Stealing Your Oil

![]()

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Tue, Jul 31, 2012 at 10:47 PM

Subject: China is Stealing Your Oil

China is Stealing Your Oil

By Keith Kohl | Tuesday, July 31st, 2012

We don't hold much faith in politics here at Energy and Capital.

And that's especially true when an energy plan is involved.

We've heard promises of energy security and ramblings on becoming energy independent from every president since Nixon...

Unfortunately, the red tape is wrapped so quickly — and so thickly — around these policies, it's not often anything makes it from the planning stage to the actionable stage.

A good example: The bickering taking place over the Keystone Pipeline expansion, never mind the fact that there are already 2.3 million miles of oil and gas pipelines crisscrossing the United States.

How many times in the past year have we seen politics play a decisive role in some new project? It's enough to give anyone a headache.

Today I want to take a look at a real approach to energy policy. It's a plan that puts ours to shame.

Advertisement

Free at Last: 430 Billion Barrels of American Oil

The U.S. Department of Energy estimates 430 billion barrels of American oil are "technically recoverable" — but only if the right technology can extract it.

That technology is here.

Not only that... Companies are already using it to increase production as much as 1,000%!

A Real 'All of the Above' Energy Plan

China accounts for more than 20% of the world's global energy demand.

As you may know, the Middle Kingdom surpassed the U.S. to become the world's biggest energy consumer in 2009. Today the race is still neck and neck.

And if the market has grave concerns over slower growth in China, somebody might want to tell China that...

China's growth is the main reason the country is so interested in securing its future energy supplies. And nothing is off the table for them — including outrageous plans like mining the moon for helium-3.

Luckily, China's real targets are much closer to home. Back when Eni released its Oil and Gas Review 2011, we saw how quickly they were catching up to U.S. oil consumption...

Do you think China is dumb enough to trust in OPEC to keep them well supplied?

Can we really expect them to continue getting gouged by Russian fuel exports?

The answer to both these questions is a resounding 'No.'

Advertisement

419% Gains from Clean Energy?

It's not a myth. In fact, it's quickly becoming reality...

One company is turning America's natural gas boom into a source of huge clean energy profits. They're on track to corner the market in natural gas drilling enhancements — and right now, their stock is dirt cheap.

To learn more, simply click here.

China's Energy Race Heats Up

To say that China is buying up our future energy supplies would be a gross understatement.

Over the last few years, we've seen this time and again through their strong merger and acquisition activities.

Things are heating up with two of China's latest deals: CNOOC's $15.1 billion buyout of Nexen and Sinopec shelling out $1.5 billion for Talisman Energy's stake in the North Sea.

Hey, if you can't beat 'em, just throw a lot of money around, right?

What's interesting here isn't so much the amount of cash that China spent, but rather where they're spending it... Not only are they dishing out billions of dollars in the North American shale boom — but they're more than willing to go anywhere for these resources.

In one fell swoop, CNOOC picked up operations in the North Sea (Nexen was one of the leading producers in the UK North Sea), the Canadian oil sands, and the rich shale gas resources in British Columbia.

We've known for a long time this deal was in the making. China's newly acquired operations in British Columbia's Horn River Basin is a precursor for the LNG exports that will soon be sent across the Pacific.

So, what's next on China's agenda?

Advertisement

Millions are Clueless about This Emerging Technology

MIT scientists, top stock analysts, and power companies agree: This technology is about to shake up America's energy future — launching one firm's share price several thousand percent in the process.

The only problem is it's been shrouded in secrecy for the past four years.

So most investors won't know about it until the biggest gains are already made.

If you're looking for a potentially life-changing opportunity, you have to see this.

Oil Off the Radar

Here's a little-known fact about these buyouts: Sometimes it's not just the new oil fields the buyers are after.

Truth is the Chinese are also benefiting by gaining access to the technology being used to reach these new oil resources.

Take their interest in the various U.S. shale plays, for instance. The real prize isn't production, but rather learning how to extract the oil and gas from the shale formations.

Believe me, dear reader; it's no coincidence the Chinese are spending billions of dollars here while trillions of cubic feet of natural gas lie trapped in Asian soil.

The next leg of this energy race may not come from new, huge oil field discoveries — but rather from pumping oil we know is already there.

Don't forget that conventional drilling methods can only produce a small percentage of the total resource. (In the United States alone, there's an estimated 430 billion barrels that are still obtainable.)

The biggest boon for China will be the technology to produce the billions of barrels that are currently unattainable using today's techniques...

My colleague Jeff Siegel's latest investment report highlights one technology that's showing groundbreaking results in reaching this abandoned crude.

The best part is that this energy stock is still flying under Wall Street's radar — for now.

Just imagine what will happen when China catches wind of this technology and starts digging around in its deep pockets...

Until next time,Keith Kohl

A true insider in the energy markets, Keith is one of few financial reporters to have visited the Alberta oil sands. His research has helped thousands of investors capitalize from the rapidly changing face of energy. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital as well as Investment Director of Angel Publishing's Energy Investor. For years, Keith has been providing in-depth coverage of the Bakken, the Haynesville Shale, and the Marcellus natural gas formations — all ahead of the mainstream media. For more on Keith, go to his editor's page.

The Bottom Line

Related Articles

Oil Recovery OpportunitiesShale Oil's Threat to OPEC U.S. Companies Invest in Chinese Shale Gas The Marcellus Shale Factor

Recently...

Energy and Capital's Weekend EditionAn Economic Boost from Natural Gas Shut Out Foreign Oil and Make a Few Bucks New Mines Coming Online Soon Don't Confuse These Two Oil Investments | |

This email was sent to . You can manage your subscription and get our privacy policy here.

Energy and Capital, Copyright © 2012, Angel Publishing LLC, 1012 Morton St, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

--

Monday, July 30, 2012

Fwd: More Jobs than Obama Knows What to Do With

Black solar, fracking, new fracking methods.. The energy sector in US is growing and

employing a lot. It should be an antidote to current US economic malaise?

Has the energy sector performance reached the tipping point? Innovation is also alive and well

in US. Together, can they save US from the $100 or so trillion public debt?

employing a lot. It should be an antidote to current US economic malaise?

Has the energy sector performance reached the tipping point? Innovation is also alive and well

in US. Together, can they save US from the $100 or so trillion public debt?

---------- Forwarded message ----------

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Fri, Jul 27, 2012 at 11:20 PM

Subject: More Jobs than Obama Knows What to Do With

![]()

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Fri, Jul 27, 2012 at 11:20 PM

Subject: More Jobs than Obama Knows What to Do With

More Jobs than Obama Knows What to Do With

By Keith Kohl | Friday, July 27th, 2012

They can't say we didn't see this rebound coming.

The signs of a natural gas rally were all there...

After all, it was only four years ago that natural gas prices topped off at $14 per MMBtu at the Henry Hub – and it's been a hard fall ever since.

Prices reached a new floor below $2.00 per MMBtu back in April.

Thankfully, the natural gas price story has taken a turn during the last three months.

Although we're still down almost 8% for 2012, prices have bounced more than 60%:

Of course, we're not actually expecting to see another pop to $14/MMBtu again.

And despite the record low 518 natural gas rigs operating (the lowest in 13 years) on U.S. soil, production is still heading higher. Data from the EIA reveals production from the various shale formations across the country is 24% higher than a year ago.

By the way, that rig count is expected to drop another 30 by year-end, leaving us with one solid option.

Before we go any further, let's have a quick recap...

Advertisement

How to Profit from the Demise of Hydrofracking

Hydrofracking has netted Big Oil billions of dollars — but this environmental destroyer is on its way out...

Now a cleaner alternative is making headway in America's largest shale formations.

The best part? This technology actually increases production by 80%!

To get your free investor's report, click here.

Marcellus Shale Boom Continues

The Marcellus Formation, which stretches roughly 600 miles across New York, Pennsylvania, Ohio, and West Virginia, is relatively new to the scene.

And it remains one of the best gas plays for investors...

You see, it wasn't until a few years ago that companies were able to commercially produce natural gas from the play.

How much gas are we talking about?

The EIA's 2012 Annual Energy Outlook estimated the formation held 141 trillion cubic feet of unproved technically recoverable natural gas (that's the amount estimated with reasonable certainty to be commercially recoverable).

Few other plays could boast having more.

The production growth alone since 2008 has been staggering — and nearly all of it has been coming from just one state:

The success in the Keystone State is reminiscent of the success seen in plays like the Bakken, something we've witnessed firsthand.

Advertisement

Have You Heard of "Black Solar"?

A tiny $1.00 tech firm in Upstate New York just did the impossible...

They unlocked the secret to harnessing solar energy by doubling the power output and cutting the cost in half.

This technology is so efficient and affordable, electric companies are already shaking in their boots.

Before the first big ticket contract comes, doubling the share price, click here to see why it's all the rage.

Got Jobs?

You'd be hard-pressed to open a newspaper or even stand in line at the grocery store today without hearing some complaint about job growth — or lack thereof.

Last week, Pennsylvania's Department of Labor announced the unemployment rate for June stood at 7.5%.

Meanwhile, residents of North Dakota have the veritable boom taking place in the Bakken to thank for their state's 2.9% unemployment rate.

And while the disparity between those figures seems great, they have something in common...

The oil and gas industry is responsible for the real job growth in both places.

Over the last year, employment in the mining and logging industry (which includes Pennsylvania's oil and gas sector) grew 21.2%.

And this same success story is unfolding across the United States...

In 2010, developing the unconventional gas deposits supported as many as one million jobs. In less than three years, it's projected that number will increase to 1.5 million jobs.

Even the drilling slowdown hasn't been as drastic in Pennsylvania as it has elsewhere...

A Marcellus Stock with a Strong Upside

Last week, I suggested investors take a closer look at Cabot Oil and Gas, one of the largest players in the Marcellus.

The last time I brought it up with one of my readers, they were adamant that there was no better opportunity than the major oil companies, like ExxonMobil.

And some of you might remember when Exxon made its first venture into the U.S. shale arena after purchasing XTO Energy for $41 billion...

I'll be the first to tell you it's easy for investors to be distracted by the big names.

But how do they stack up against smaller companies like Range Resources, the company that drilled one of the first successful Marcellus wells back in 2004?

Not even close:

Range Resources has experienced double-digit production growth for the last nine years — and that's even with the dramatic decline in gas prices since 2008.

There's an added bonus for investors in these huge shale plays, and it's not just the producers that will come out on top...

When it comes to our shale plays, we're looking at decades' worth of drilling still to come — and profit from.

But here's the rub for these drillers: There will be much more scrutiny over the production process than ever before due to hydraulic fracturing.

Talisman Energy was recently fined by the EPA for violations at 52 natural gas wells in Pennsylvania for failure to disclose health and safety information about the chemicals used on site.

Going forward, we're going to see even tighter regulation as the debate over hydraulic fracturing rages in the media...

That's why finding a way around these regulations is so valuable for drillers and investors alike.

Here's one company solving those issues that just set up shop last year right here in the United States.

Until next time,Keith Kohl

A true insider in the energy markets, Keith is one of few financial reporters to have visited the Alberta oil sands. His research has helped thousands of investors capitalize from the rapidly changing face of energy. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital as well as Investment Director of Angel Publishing's Energy Investor. For years, Keith has been providing in-depth coverage of the Bakken, the Haynesville Shale, and the Marcellus natural gas formations — all ahead of the mainstream media. For more on Keith, go to his editor's page.

The Bottom Line

Related Articles

Natural Gas Price IncreaseFaith in the Bakken Graphite Mining Stocks Three Natural Gas Stocks

Recently...

New Mines Coming Online SoonDon't Confuse These Two Oil Investments Muslim Terrorists Invade the Capitol Building! Energy and Capital's Weekend Edition 2012 Natural Gas Investments | |

This email was sent to jorgeus.george@gmail.com . You can manage your subscription and get our privacy policy here.

Energy and Capital, Copyright © 2012, Angel Publishing LLC, 1012 Morton St, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

Subscribe to:

Comments (Atom)