The Arabs are running out of oil and fast. Their output is declining; and what remains are low grade crude oil - heavy and difficult to refine. Unlike the Libya and Brent crude. What is going to happen to Saudi?

What is the next step? What will happen to them if they have been dependent on oil, and the citizens have been kept on welfare by huge oil money?

From: Energy and Capital <eac-eletter@angelnexus.com>Date: Sat, Jun 2, 2012 at 9:06 PM

Subject: What the Saudis Aren't Telling Us

What the Saudis Aren't Telling Us

By Keith Kohl | Saturday, June 2nd, 2012

Suffice to say the triple-digit oil prices we've seen over the past few years have been good to the Kingdom of Saud.

By the end of next year, Saudi assets are projected to top $1 trillion.

When two-thirds of your income is tucked away in your oil industry, it allows you to increase spending on other things, namely education, health care, jobs and infrastructure...

At least we'll have a front row seat to their fall.

Saudis' Fading Fortune

Ever wonder what it takes to give a Saudi prince nightmares?

Here's a hint...

What could possibly hurt the Saudis' purse more than this?

Together, WTI and Brent crude prices have fallen about 20% during the last thirty days, despite the fact that summer is upon us.

But it shouldn't be the crude price slide that has them worried...

Advertisement

King Saud Should Sue

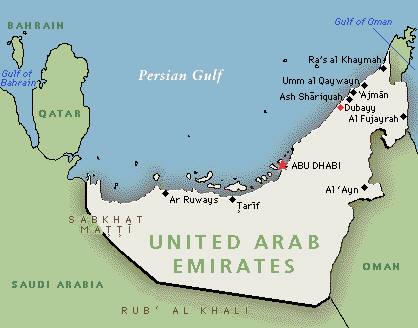

It's no news that the Saudis are running out of oil, and fast...

And now it turns out as much as $7 trillion worth of oil that was once theirs is now in the hands of another nation.

How is this possible?

Find out how geology — and fate — misplaced one of the world's biggest oil fortunes... and the company that now has it in their hands. Click here.

The real concern here is on the demand side of things.

What will happen when everyone suddenly realizes things aren't going so well for OPEC members?

And when global demand rebounds, how soon will it be until the spare capacity dries up?

Although Saudi Arabia's oil production is chugging along at more than 10 million bbls/d, OPEC spare capacity is at its lowest point since 2008.

And there's another problem hidden in the details. Saudi spare capacity — which stands at a little more than two million barrels per day — isn't the light, sweet crude the refiners prefer...

Remember when 1.5 million bbls/d of Libyan oil was taken off the market last summer?

We got a good taste of the poor quality of their spare capacity.

The heavy, sour oil coming from Saudi fields was a poor replacement for the light, sweet Libyan supply — especially considering European refiners weren't equipped to handle it...

Not to mention the fact that domestic demand in OPEC countries has been on the move:

In 2010, Saudi Arabia's oil demand increased to 2.4 million barrels per day.

At this pace, they'll be consuming more than three million barrels per day in three years — and over four million barrels per day by 2020.

It's a good thing we won't be begging them for more oil going forward...

While the Saudis are adding extra-heavy, sour grade crude to their production, we've admittedly had it better.

By now, the resurgence taking place in the North American oil industry is more than just hype.

The 6.2 million barrels of crude projected to be pumped out of U.S. oil fields this year will the most since 1998 — making now the perfect time to go long on oil stocks.

Enjoy your weekend,

Keith Kohl

Editor, Energy and Capital

Securing Extra Income: How to Make Safe Returns in a Volatile Market

Every day, thousands of investors are finding the safest, most reliable way to profit during a recession. The secret is to make some of the world's largest retailers pay you each month.

Investing in the Next Miracle Metal: This Game-Changing Metal is Finally Getting its Due Attention

From breakthroughs in modern medicine to superior, cost-efficient ways allowing oil and gas drillers to boost production, the technological implications for this "miracle metal" are practically endless.

Natural Gas Vehicle Boom: Afford to Retire on Time

Analyst Ian Cooper uncovers a simple investing solution for baby boomers wanting to retire on time.

Silver, BAP and License Plates: Investment Ideas for a Deleveraging World

SLV is overdue for a bounce. It has been consolidating for the past 13 months and is down by almost 50%. The gold-silver ratio is running into strong resistance at 59:1... This indicates that all the fast money has sold silver and investor sentiment is bearish.

Here's the Next Bull Market: Two Unlikely Stocks Making Record Highs Today

The next investment bull market is easy to spot. And it's already started despite the housing depression, credit default swaps, and Spain and Greece. I think it'll last for the next 20 years...

Finding Long-Term Value in Natural Gas: The Holy Grail of U.S. Energy

Energy and Capital editor Keith Kohl explains why the upcoming transition to natural gas is one of the greatest investment opportunities in today's volatile market.

Graphite Investments: Which Graphite Companies Are Best?

It's been called a "miracle material" and "the newest next big thing" by scientists and market analysts alike. But more important than what it can do for energy and technology is what it's going to do for investors.

Balancing Fear and Greed: Don't Be Scared

If you're full of fear, you're not playing to win... you're playing not to lose.

Who Wins Greece?: Trading the Endgame

CNBC is now reporting Greece will leave the Eurozone on June 18th if the populist government wins the country's elections on the 17th. I am trading this situation on multiple fronts.

A Golden Ticket in the Golden Age of Gas: It's Time to Break the Rules

Why breaking the IEA's golden rule to natural gas could fuel profits for these investors...

The Bottom Line

Related Articles

Finding Long-Term Value in Natural GasSolving Fracking's Water Issue Deepwater Oil Investing Investing in Fracturing Technology

Recently...

The Holy Grail of U.S. EnergyWhich Graphite Companies Are Best? It's Time to Break the Rules Energy and Capital's Weekend Edition The Next Generation Frack | |

This email was sent to jorgeus.george@gmail.com . You can manage your subscription and get our privacy policy here.

Energy and Capital, Copyright © 2012, Angel Publishing LLC, 1012 Morton St, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

0 comments:

Post a Comment